This month, we hosted a live Q&A Webinar to answer some of the most common questions we are asked about our Crowdfarming™.

Our CEO answers the most frequently asked questions:

- Who is Livestock Wealth regulated by?

- Are my investments Insured?

- What happens if my asset dies or is damaged?

- Who owns Livestock Wealth?

- Is my return or profit guaranteed?

Have more questions?

Go to:

livestockwealth.com/frequently-asked-questions/

Ready to Invest?

Go to:

https://dashboard.livestockwealth.com/register/

Transcription:

Thank you everyone for joining in. I really value each and every one of you that came through to to be with us on this webinar today, thank you for just making the time, you know, to to give us an ear.

I’m Ntuthuko Shezi, I’m 41 years old, I live in Johannesburg with my wife and my two daughters Sinqobile and Kwandile. Kwandile is 5 months old.

I’ve been a businessman since 2006. In my previous life I was a strategy consultant at Accenture. Some of you may know the company, if you receive a bill from Eskom, the guys who designed the bill, what it looks like, where each field goes, how you get billed, how they decide to cut you off, that was my colleagues.

But being in a corporate I did very well, I was very successful. I was on the fast track to being partner, but I had something eating me up inside of me which was – am I really doing everything I can to be changing the world?

So that thing always bugged me. So finally in 2006 I got enough courage to to resign and start a business.

Some of you may know my businesses at the airport – Scratch Mobile which does panel beating, you can check it out there. And then we also have another business, that’s also at the airport, that one of my companies runs as well is – First Class Parking, which is the official Valet parking operator at O.R. Tambo airport, for all the busy executives, celebrities, we park all their cars while they fly and fix their dents and scratches as well. So that’s been going for about 14 years now.

But even then, you know, I was like OK, is fixing cars really changing the world? Yes, you can help hide, if there’s a wife who scratched the car and they wanted to fix the car really quickly before the husband finds out, so I fix the car quickly and return it quickly, so I save a marriage there, you know, but it’s not really changing the world.

My grandfather was a “Mailboy”.

So I then had this idea for the longest of time to create Livestock Wealth and there were many influences of it and the bulk of them from my parents and grandparents being agriculturalists while they were young, at a small scale, but I could see, looking back you know, because they say hindsight has got the best vision, I could see how my family was able to move from my grandparents who were my grandfather I think was a mail, they called them mailboy in the 50’s. So his job was just to deliver mail between offices and then my grandmother was a cleaner, she just cleaned houses, people’s homes in in Morningside in Durban.

But looking back I was able to see how the the few cows and the few entrepreneurship things that my Grandma did were able to propel our family from object poverty to middle class where my mom was a Teacher and to me who became an Engineer an Electromechanical Engineer and my kids can be anything they want you know, if they want to be a Ballerina they’ve got a very, very strong chance of being a Ballerina without having to worry where the money is going to come from.

Power of Agriculture as a Transformative Power.

So for me that is what I saw is the power of how agriculture is a transformative force in Africa so which is why then I started Livestock Wealth you know with a bigger vision of saying, man this country is the most unequal country in the world, we lead in inequality.

What does that mean?

That means across the road there’s health care for a few people who can afford medical aid and on the other side of the road there’s a very shaby facility where people are condemned to die. I’ve had two experiences with close friends of mine where they could have lived had they only had medical aid or enough money just to be admitted to the emergency room of the private hospital.

One instance happened for me in 2013 with my great friend, he was a welder, he was ill in hospital. I went to visit him then and I could see that this guy is on the clock and then I called his father and said; “I’ve got R30,000 can you just put in R20,000 so that he can be moved to the next hospital because that’s what they want as a deposit.” We were doing a lot of work together like on contract you know, he was a welder there was a job that’s what was long delayed for us to start so I knew that there’ll be money to be able to cover the R30,000 from somewhere but his father sadly couldn’t provide the R20,000 and then he stayed in the public hospital and two weeks later I got a call that he had passed on.

This family has about 30 or 40 cows.

My wife and I drove to the hospital to where his home was we drove there and when I got there I got a shock of my life that this family has about 30 or 40 cows sitting in a club because for the day of the future all the cows have to be on the crawl and those cars are worth easily half a million rent yet they can’t find R20,000 then the funeral policy that all paid so there was enough money to bury him there was catering for us there was all these other nice things VIP area and all that nice casket but why is there no R20,000 to bury to keep the guy alive that’s the question that I still ask myself to this day and someone saying why are there no financial products that really care about people so now I’m never a person who loves to complain.

Value of cows.

I find problems and I do something about them and then Livestock Wealth was one such outlet for me and for me the world I’m creating is a world where all farmers across the continent of Africa with all their cows are able to realise the value of their cows.

Today those cows on the platform, they are tracked by our tracking system we’re able to to guarantee the person’s creditworthiness based on how many cows they have whether it’s an investor who owns those cows or even the farmers.

I want to create a world that my team is committed to this of an Africa where there is no piece of ground that is not planted where there’s other trees coffee trees, where there is macadamia trees all across and and in that world there is processing plants that process those macadamia, this industry that provides irrigation, this industry that provides irrigation and tractor repairs and all those things and then there’s jobs

And then in the world then there’ll be no inequality because everyone can be able to stay alive and have a choice to stay alive so that’s me and that is why I’m standing today.

We started off in 2015.

You guys know our history, you can go on google, with 26 cows we grew we’re now managing close to R100 million worth of assets and this is assets in macadamia, in free-range cows and pregnant cows in all parts of South Africa and we’re not planning to stop there. Our vision is bigger, it’s bigger than South Africa it’s it’s it’s continental and we have you guys have seen how our work has been featured and supported by various organizations, your CNN’s, Carte Blanche and everything else, and I believe that you guys are all here today to say you spent that 40 minutes that we invited you and say how can I be part of this and we want you to be part of our vision of changing the world, in this way through Crowdfarming™. So I’m gonna just dive in to say how does our investment in cattle and agriculture work?

How does Crowdfarming™ work?

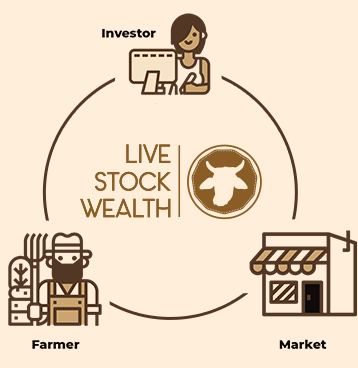

I think there is a slide there, not sure if it’s showing yet, OK, so we act as this bridge between the farmer and the investor and the market.

So what does that mean? It means we have farmers who already are farming. These are not wannabe farmers, these are farmers with skin in the game, with plants on the ground, with cows that are walking, alive and healthy. We have those farmers and we vet these farmers. We find them, we’ve got a team that finds these farmers, does credit checks on them, makes sure they are good enough to be trusted such that you as the investor sitting in JHB, sitting in New York, can buy that cow that is sitting in their farm and be the new owner of it and it’s being cared for by the farmer while it grows or while the baby inside grows and then that’s a fixed term investment that ends when the when the calf is sold.

That normally takes about a 12 month process and then when the baby is sold then there’s money coming into the farm because the babies at today’s prices are worth about R8,000 or so, so then the farmer is able to then say – Mr. Investor, you’ve partnered with me for 12 months, you’ve owned this cow so after 12 months I’m gonna buy back this cow from you for more than you paid me for it because now it’s value has increased because now it’s a mother and a calf so if you had bought the cow for R18,000, you then buying it for the farmer is buying it back for R20,000 giving you a 11 or 12% return on investment depending on how the beef prices perform.

Now other people may ask why don’t I keep the calf?

Why don’t I keep the calf? There’s too much risk in keeping the calf, there’s no knowledge of whether the following well del calf will be barren or feta and it’s going to take three years for you to find out.

Imagine three has lost owning a calf that is barren and then also with the mother why is it 12 months only is because there is no guarantee that the the cow will be pregnant in the following year, in the following season so there’s no guarantee that the cow will bring in money next year.

So to make sure that you as the investor are not involved in the risks of pregnancy, you are only involved with the cow for a fixed period of time while we know for sure that it’s pregnant.

Macadamia is one of the highest grossing crops in the world at the moment.

You earn more money planting macadamia in one hectare than anything else so what we do because to grow macadamia takes about six years so you have six years where you have to buy the land, prepare the soil, plant the tree, fertilize the tree, put irrigation, maintain the tree for six years before you see a single payday as a macadamia farmer.

So what does that mean?

It means that only the most affluent people, private equity funds are able to own macadamia plantations. If you go in South Africa, in Venda, all those macadamia plantations that you see, most of them are owned by UK private equity funds.

Why?

Because local farmers don’t have six years of money to put into a tree, so we then partner with the farmer and say hey Farmer Gene, you’ve got the tree, you’ve got the skill, you are good at this thing, we’ll buy the tree once it’s on the ground, you sell it to our investors on our platform.

As Livestock Wealth we make a commission from each sale, that’s how we keep the bills alive and keep our our our the lights on and make we make that commission and then Gene has got money to maintain this crop and make sure it’s the best crop when it comes to markets in six years and he’s in a position to buy back that tree from you the investor, for nearly or over double the money. So that’s what we’ve done with macadamia, where we’ve created a way for money to really grow on the tree.

OK so then the biggest question that people always ask now is my money safe?

- Can I trust these guys?

- Who are these guys?

- Can they really be trusted?

So one of the things that we’ve done from day 1 is make sure we had top-tier auditors, so at the time when we started it was Siza SMG. In fact we’ve employed some of their ex staff as our accountants and CA’s into the business, we’ve had top-tier auditors from day 1.

They’ve changed the name now, they’re part of Grant Thornton, so we have Grant Thornton as our auditors. These are people that come, they check our books, make sure that everything that we say we’re doing is what we’re doing.

OK and secondly there is the technology and there’s a due diligence that we’re bringing towards vetting the farmers.

I think I’ve talked about that. We visit every farm and we make sure that during this time of your investment we are always there keeping an eye on the farmer, keeping an eye on your investment too.

Then we also have a tracking device, you’re gonna see in the media in the next couple of weeks, every cow that’s on our platform is going to have this device, which tells us that the cow is on the farm, it’s within the fence. If there’s something happening to the cow at night, even you the investor, whether you’re in New York or in Venda or in Johannesburg you’ll be able to see that – hey something is happening to my cow and the farmer is able to react quickly, so that brings in an extra layer of safety.

We also have insurance as well.

So like Macadamia for example, where the markets are matured, all the farmers that bring in that Gene has an insurance policy for his Macadamia, so if something happens to the orchard, if there’s fire etc. your investment is safe.

Lastly we are regulated by the Agricultural Produce Agents Council

APAC is a statutory body that regulates agricultural agents, because as Livestock Wealth we work as an agent that connects you the farmer to the investor today and then 6 months later at harvest we then act on behalf of you the investor now working with you to sell the product to the market, or to sell the product back to the farmer so that’s the regulation environment that we are in and it’s a regulator with real teeth – with complaints resolution processes, with registration processes, with ways of investigation, with ways of dismissing people who don’t comply with the promises that they’ve made and with the statutes of regulation and the Agricultural Produce Agents Council is an agricultural body led by the minister of agriculture that is passed by an act of parliament but pertaining to agricultural products, which is the space that we are in.

People always ask how do I start and invest?

I’m gonna share my screen and then I’ll take you guys on a journey and say how do I buy my first cow. Ok so there you go, you go to our website livestockwealth.com.

Live Q&A section:

We have our first question from Lerato, she wants to know if one invests in a calf with 7% interest, is this the annual or the monthly?

Ok, I think the question there is if I invest in a Free Range Ox, what’s the return after six months? So the 5 – 7% is at the end of the period. Think of a fixed deposit at the bank, fixed deposits work in exactly the same way, so think of the free range ox as a fixed deposit where you’ve deposited your money in the cow with the farmer by owning the cow and then six months later at the end of investment you get your money back plus the profits, that means that your R11,529 would have grown to about R12,100 up to R12,300 depending on how the beef prices perform.

We have our next question from Namata, it’s:

When can you make your platform have dollar accounts to reduce the impact of exchange rates for foreign investors?

Yes, thank you for that question. We are coming there, we are busy on that process, it’s something that as a CEO, that is the top of my agenda in the next 6 months that your investment, regardless of country you are in, is protected from the volatility of the South African Rand. But what I am aware of though is that you know we’ve had investors since 2015 who’ve been invested with us and those who’ve stuck with us over the years have grown their money, you know in real dollar terms as well, so that is the one thing that we are really working on to make sure that we’ve got those options. So thank you for the question.

Ok, we also have another question from Marieke. I hope I’m pronouncing this correctly.

They would like to know how their returns will be taxed in South Africa?

Sure. So in South Africa, with the advice that we’ve received from the top legal minds and tax minds that we’ve consulted is that the assets are growing in value so it is considered as a gain or as a capital gain, because you are the real owner of this asset, it’s almost like a house, so there is a capital gain, and you guys can check with your brokers as well and your financial advisors, that every year there is a threshold. I think the last time the threshold was R40,000 where if your gain for the year is less than R40,000, so it means that you’re owning like 20 cows and your profit of R2,000 is R2,000 X 20 is R40,000 then that portion is not taxed for capital gains.

That’s the advice that we’ve received and that’s the advice we’re also giving to our investors. But also importantly is your financial advisor, understanding that we’re treating the cow as an asset, can advise you further in terms of how to manage your own individual circumstance.

All right, we have a very common question from Olga;

When are the connected gardens going to be available?

Great question Olga, great question. The connected gardens are coming back from next month. From the 1st of march we are opening up the connected gardens again. We’ve partnered with a brilliant farmer, I think she should be on this call, a company called Azeroth projects and we are looking for other great farmers as well who we can partner with who will own, you as the investor you own the connected garden and it’s rented out to the farmer who then all they have to do is just produce whatever they produce and take it to market and pay a monthly rental that gets paid into your account every three months, or you see all that every three months so they that we are really excited that the gardens are really coming back.

How long does it take to buy a 2nd cow when you reinvest?

Sure, great, that’s a good question. So if you start, we’ve got an investment calculator on our website so the question that you asking you can actually go to the website and put the investment already choose one cow, choose number of years and you’ll see how your profits works.

But there is a secret formula to investing in cows and that is, if you have enough cows that you own, that you are targeting to own, even such that the profit you getting from the cows every year is able to buy you an additional cow, without you putting any money of your own, that is the magic. So now for pregnant cows, if you have at least 9 cows or 10, then every year you’re getting 2,000 x 10 which is about R20,000 in profits from your cows then the profits are able to buy you cow number 11 without you putting any new money of your own, without digging into your pocket.

So then every year that compounding effects just keeps happening so this is the money growing on its own just like compound interest at the bank where interest ends more interest that’s the point that you want to get to as an investor so if starting with one cow yes you can start with one cow but if you want to see real gains get to a point do a number where the profit I’m getting every year is able to is able to to to buy me an additional account and then my number of cars keeps increasing without me putting in new money then then the investment really is working for you money growing while you sleep.

So we have a question from Machali, they’re asking if we can buy a portion of a cow or a tree in installments?

We’ve had the portion of the tree as you can see in some of the past media, or portion of the cow rather, but what we decided to do was to say, you know, the investment in the cow is something that’s a stretch target for you the investor.

Nothing happens in your life unless you stretch yourself so we saw that if someone puts in 500 bucks and they make profits of 30 bucks, that person will never be happy because they’ve put in little, they’re getting out very little and then everyone is unhappy and we then said OK everyone must invest in a full asset so we make sure that we’ve got cheaper assets like the tree for R2,000 but for the cows you are able to just put money in your wallet and leave it there. It currently is not earning interest yet, we’re working on ways to do that, to do that legally, because we can’t just give you interest if we are not a deposit taking institution, but we are working on that with our legal minds.

So even when the money is there while you are saving up towards your full cow, that the money could be growing at a few percentage points. But if you if you can, over three months, OK it’s just R5,000 or R4,000 in this month, R4,000 the other month and then R4,000 the other month and boom you have your first investment you know and that’s a stretch target that then makes you really treasure the investment as well.

Ok, we’ll take the last one from Simesha, she wants to know about our farming practices.

Do we practice sustainable climate methods, sustainable climate farming practices and is it possible to visit the farms?

We care about the world this is one thing I do, I want as a CEO of the company my job is to create, my company must create the same world that my children will live in and their great grandchildren must be able to live in. So one of the things that I believe in is, for example, to make sure cows grow in a natural environment, this is why we are very pedantic about free-range, grass-fed beef.

That the cows mustn’t be grown with stimulants and packed up like sardines in a can just so that it’s pressed for time to get to the supermarket and we get meat that is full of hormones and growth hormones and antibiotics that have got health complications later.

So obviously at the farms, our farmers are good farmers who care for the environments. They are not miners because miners take away from the land but farmers replenish so that there’s something there for tomorrow.

More Questions?

We’ve got a FAQ section so most of the questions you’ve got have already been answered on the website so just visit https://livestockwealth.com/frequently-asked-questions/ and if there’s any other questions that you have you can email them to us and also we can email them to us but we will because we’ve got your email addresses as well from your registration form so when there’s a question that we see is from you we will endeavor to make sure that we’ve responded to it or even at least just point you to the place on the website where you can find the answer.

Ok, thank you very much everyone.

Don’t forget, download the app, start investing, go to the website and invest in the web app. Don’t delay because there’s some people always say I’ve been following you for the last 5 years. You know, why follow us for 5 years why you can’t just invest you know you could have had 5 years of returns and the 5 years have been part of the vision so I implore you to start today, tomorrow is too late.

Thank you everyone.

Goodbye.