We’re excited to be launching our new Crowdfarming™ Farmland Ownership asset, where you buy the asset, we farm, and you get the profit.

You own, we farm,

you profit.

We’re excited to announce a Farmland Ownership Opportunity where you own a portion of a farm and earn profits from its operations. Our Crowdfarming™ platform enables multiple buyers the ability to co-own an operational farm.

The farm, with 92 hectares of planted citrus, is operated on your behalf by Livestock Wealth and its appointed managers with a goal to earn you profits annually.

Our farmland ownership is in full swing, now that we’ve secured a whopping 577-hectare property that holds immense potential. You can own a piece of this farm today.

1. Own

You buy one of the 4,121 portions of the farm and become the shareholder in the Farmland Asset. Each portion equates to one share.

You buy the land

R5,000

2. Growth

Livestock Wealth will perform the job of the managing agent on your behalf, the owner, with the aim of growing the value of the farm.

Min. holding period

5 Years

3. Profit

Annual rental profit earned by land owners will be based on the farm profitability per year. Our role is to maximise farm performance.

TARGETED PROFIT

9% pa

4. Sell

If the value of the land increases such that it makes sense to sell, owners can earn a higher payout from the sale.

MAX RETURN

View Projections

How it works

Livestock Wealth manages and you benefit as the owner.

Everyone who buys one of the 4,121 portions of the farm becomes the shareholder in the Farmland Asset. Each portion equates to one share.

We will perform the job of a managing agent on behalf of you, the owner. We manage the farm on your behalf including, managing the staff, looking after the orchards.

The full benefits of owning the farm rest with you and it is our responsibility as Livestock Wealth to ensure that the farm performs to its full potential.

The Asset

Asset information and numbers

R20.6m

INVESTED

577

HECTARES

92ha

Orchard Size

Property details:

Location

Limpopo, Musina, Tshipise.

Coordinates

22°31’48.1”S 30°10’08.3”E.

Crop type

Lemons, oranges and grapefruit.

Land size total

577.243 hectares.

Packhouse

1,74 Hectares.

Purchase date

2 October 2023.

Ownership Type

Shareholding in the company.

The finances:

Total being raised

R20,606,000.00

Price per portion

R5,000.00

Portions on sale

4,121

Maximum units per person

Not limited.

Targeted Annual Return

9%.

Lifetime ownership of the farm with a minimum holding period of:

5 years.

Fees

Once-Off Acquisition Fee: 3%.

Annual Management Fee:

2% of Net Asset Value.

Performance Fee:

50% of Return Above Target.

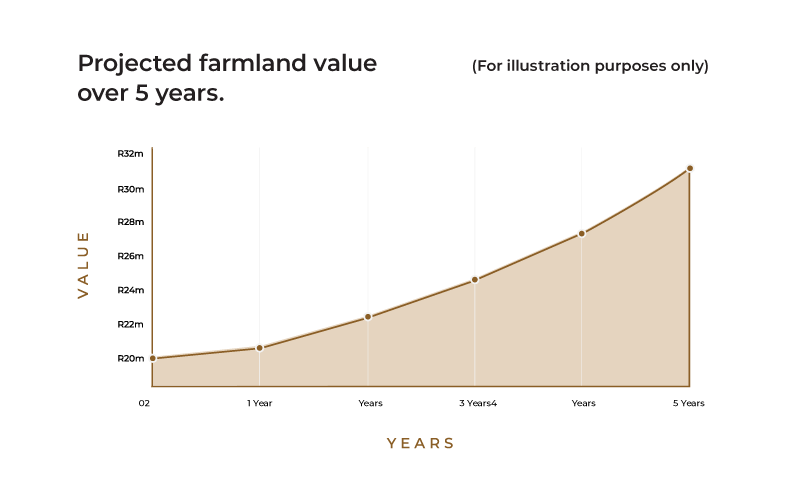

How does your wealth grow?

Annual profits from operating the farm and increase in the value of the farm.

Projections:

Why Citrus?

Citrus, known as the golden fruit and an export powerhouse, provides a unique advantage.

Earning income in US Dollars shields us from the volatility of the South African rand.

Due to the farm’s climate and location, our lemons reach European markets two months ahead of the competition.

This ensures that our produce commands a premium price, as we are the sole region capable of supplying during that period.

Farmland growth potential & opportunities

“Potential for a solar farm and additional developments”

Besides the 92 hectares of flourishing citrus orchards, there are an additional 490 hectares of open veld currently not in use. There is an opportunity to plant additional citrus trees but only when we secure additional water rights.

A potential for solar farming.

After conducting research, we’ve identified a significant opportunity to establish a solar farm that would provide electricity to the farm and nearby farmers through a wheeling agreement with Eskom.

The packhouse

The farmland also boasts substantial packhouse, currently in the planning stages for revival. With the support of various grant funding mechanisms to bring it back into operation, the packhouse will provide the farm with an additional income stream, as we will be able to offer services and market access to smaller farmers in the neighboring villages.

Ready to own farmland?

BUY LAND“Buy land, they’re not making it anymore.”

- Mark Twain

Your land investment will be safeguarded by us, ensuring it becomes a cherished legacy to nurture and pass on to future generations.

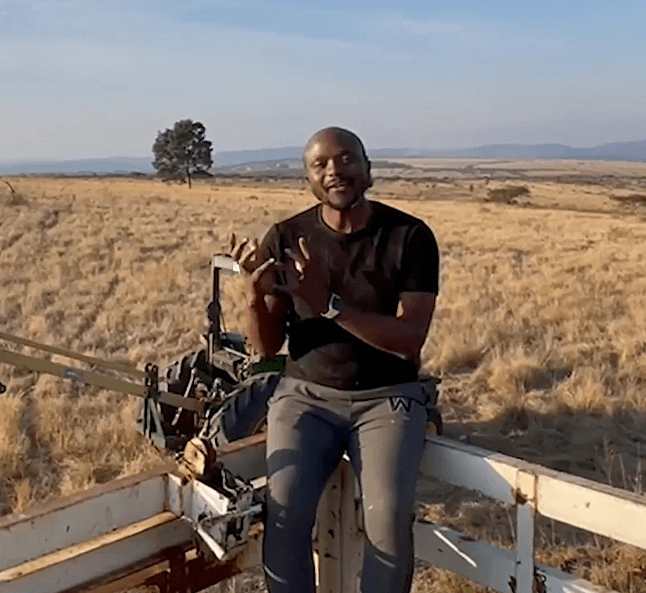

— Ntuthuko Shezi, CEO

Common Questions

Will my investment earn interest while waiting for purchase of land?

During the period before the farmland is leased, your investment will sit in a Livestock Wealth trust account, earning a nominal interest rate.

Can I trust Livestock wealth?

Since 2015, Livestock Wealth has gained over 2,800 unique investors, which have invested over R70 million and have been paid out over R10 million in profits. We have more than 30 vetted partner farmers around South Africa and have been featured on Carte Blance, BBC, CNN, SABC, TEDx, Times Live and more. Go to our press page to watch the interviews. Livestock Wealth is not only regulated by the Agricultural Produce Agents Council Act: Reg No. 155 but is also registered by SAMAC (Macadamias South Africa NPC).

May I go visit my investment property?

Yes, investors can visit the farm by prior arrangement with Livestock Wealth.

How do I receive profits or get paid out?

Your annual rental profit will be paid into your Livestock Wealth wallet which you can use to invest in other Livestock Wealth farm investments or withdraw to your bank account.

Is your farming ethical?

Since inception, we’ve used only top-tier auditors. Currently, we are audited by SNG Grant Thornton.

Livestock Wealth is also regulated as a registered agricultural producer agent with the Agriculture Producer Agents’ Council (Reg No. 155). Furthermore, Livestock Wealth is registered with SAMAC (Macadamias South Africa NPC).

How do I invest?

To start investing, you’ll need to create a free account on our Farmbook™ web & mobile app. You can register here.

We accept Credit Card, EFT and Direct Bank Transfer.

Can I sell my portion in between the investment term?

Not yet. We will be building the ability to be able to sell your unit over the next 12 months.

How much land does one get out of R5,000?

You are a shareholder in the company that owns 100% of the farm. Your share is worth R5,000.

Does one get a title deed?

Yes, you get a copy of the title deed. The title deed will be registered in the name of the company that you are a shareholder of.

Can one withdraw anytime without losing his investment?

No, you cannot withdraw at any time before the term of the investment ends. In the near future, we will create an ability for you to sell your portion of shares to fellow investors in the company.

Can one put more than R5,000.00?

Yes, you can buy multiple portions of R5,000.00.

Can one put more funds in instalments?

Yes, you may deposit at different intervals, however allocation to a farm is on a first come first served basis. This means that a future payment from you could be towards ownership of a different farm.

Is the farmland also in Gauteng?

We are looking for farms in different locations. Gauteng, due to its small size, does not generally have large farms for cattle and crops.

What is the criteria for choosing a farm and/or farmland?

Based on our many years of experience in profitable farming, we consider qualities such as accessibility, and weather/climatic conditions such as and decide whether they are conducive to farming.

Who decides how the farmland will be used?

Livestock Wealth as the director will manage and decide on the shareholders’ behalf. Every year LSW will provide the strategy for the upcoming year which will be approved by the shareholders (yourself) during the AGM.

Can an individual investor sell their portion of the land? If the answer is, yes, then how will its value be calculated?

No, you cannot sell your portion of the land at any time before the term of the investment ends. In the near future, we will create an ability for you to increase sell your portion of shares to fellow investors in the company.

Who pays for the recurring property taxes?

The property rates and taxes will be paid by the farm from the rental received from the tenant. The tenant will be responsible for all the utilities.

What are the legal and financial obligations of owning the farmland?

As the shareholder and owner of the farm, you have minimal obligations except to provide additional capital if necessary in the farm as Livestock Wealth is appointed as the manager and director of the farm. Your obligation is also to interrogate and approve the strategy during the AGM.

As a part owner, am I insured against damage for which I have to pay, e.g. B. Environmental damage?

The farm will be ensured for risks such as fire and civil unrest. Furthermore, the tenant will also ensure specific risks pertaining to whichever agricultural products they are farming.

Who can assure me that my financial resources are protected in the event of politically desired expropriations?

The farm will be ensured for risks such as fire and civil unrest. Furthermore, this investment product provides a solution for the land reform problem in the country, which any political party would support.

Can we invest as a trust/entity?

Yes, you can invest as a trust or entity.

Ready to invest in farmland?

BUY LAND“Buy land, they’re not making it anymore.”

- Mark Twain

Your land investment will be safeguarded by us, ensuring it becomes a cherished legacy to nurture and pass on to future generations.

— Ntuthuko Shezi, CEO

Common Questions

Will my investment earn interest while waiting for purchase of land?

Yes, your investment will sit in a Livestock Wealth trust account until farmland is secured.

Can I trust Livestock wealth?

Since 2015, Livestock Wealth has gained over 2,800 unique investors, which have invested over R70 million and have been paid out over R10 million in profits. We have more than 30 vetted partner farmers around South Africa and have been featured on Carte Blance, BBC, CNN, SABC, TEDx, Times Live and more. Go to our press page to watch the interviews. Livestock Wealth is not only regulated by the Agricultural Produce Agents Council Act: Reg No. 155 but is also registered by SAMAC (Macadamias South Africa NPC).

Where are your farms?

The particular farm we are look at investing in is located in Tongaat, KZN, North Coast.

Over and above that, we have several partner-farmers around South Africa. Some of our partner farms are located in:

- Lichtenburg, North West

- Durban, KZN

- Matatiele, KZN

- Kokstad, KZN

- Richmond, KZN

- Venda, Limpopo

- Senekal, Free State

May I go visit my investment property?

Yes, investors can visit the farm by prior arrangement with Livestock Wealth.

How do I receive profits or get paid out?

Your annual rental profit will be paid into your Livestock Wealth wallet which you can use to invest in other Livestock Wealth farm investments or withdraw to your bank account.

Is your farming ethical?

Since inception, we’ve used only top-tier auditors. Currently, we are audited by SNG Grant Thornton.

Furthermore, Livestock Wealth is a registered credit provider with the National Credit Regulator (NCRCP8126) and is also registered with the FSCA as an authorised Financial Services Provider.

Livestock Wealth is also regulated as a registered agricultural producer agent with the Agriculture Producer Agents’ Council (Reg No. 155). Furthermore, Livestock Wealth is registered with SAMAC (Macadamias South Africa NPC).

How do I invest?

To start investing, you’ll need to create a free account on our Farmbook™ web & mobile app. You can register here.

We accept Credit Card, EFT and Direct Bank Transfer.

Can I sell my portion in between the investment term?

Not yet. We will be building the ability to be able to sell your unit over the next 12 months.

How much land does one get out of R50,000.00?

You are a shareholder in the company that owns 100% of the farm. Your share is worth R50,000

Does one get a title deed?

Yes, you get a copy of the title deed. The title deed will be registered in the name of the company that you are a shareholder of.

Can one withdraw anytime without losing his investment?

No, you cannot withdraw at any time before the term of the investment ends. In the near future, we will create an ability for you to increase sell your portion of shares to fellow investors in the company.

Can one put more than R50,000.00?

Yes, you can buy multiple portions of R50,000

Can one put more funds in instalments?

Yes, you may deposit at different intervals, however allocation to a farm is on a first come first served basis. This means that a future payment from you could be towards ownership of a different farm.

Is the farmland also in Gauteng?

We are looking for farms in different locations. Gauteng, due to its small size, does not generally have large farms for cattle and crops.

What is the criteria for choosing a farm and/or farmland?

Based on our many years of experience in profitable farming, we consider qualities such as accessibility, and weather/climatic conditions such as and decide whether they are conducive to farming.

Who decides how the farmland will be used?

Livestock Wealth as the director will manage and decide on the shareholders’ behalf. Every year LSW will provide the strategy for the upcoming year which will be approved by the shareholders (yourself) during the AGM.

Can an individual investor sell their portion of the land? If the answer is, yes, then how will its value be calculated?

No, you cannot sell your portion of the land at any time before the term of the investment ends. In the near future, we will create an ability for you to increase sell your portion of shares to fellow investors in the company.

Who pays for the recurring property taxes?

The property rates and taxes will be paid by the farm from the rental received from the tenant. The tenant will be responsible for all the utilities.

What are the legal and financial obligations of owning the farmland?

As the shareholder and owner of the farm, you have minimal obligations except to provide additional capital if necessary in the farm as Livestock Wealth is appointed as the manager and director of the farm. Your obligation is also to interrogate and approve the strategy during the AGM.

As a part owner, am I insured against damage for which I have to pay, e.g. B. Environmental damage?

The farm will be ensured for risks such as fire and civil unrest. Furthermore, the tenant will also ensure specific risks pertaining to whichever agricultural products they are farming.

Who can assure me that my financial resources are protected in the event of politically desired expropriations?

The farm will be ensured for risks such as fire and civil unrest. Furthermore, this investment product provides a solution for the land reform problem in the country, which any political party would support.

Can we invest as a trust/entity?

Yes, you can invest as a trust or entity.

Our Story.

Farming is an ancient African wealth-building practice. But in this day and age, we don’t have the time or resources to farm.

Our innovative Crowdfarming™ platform allows anyone to own a farm and benefit from rental and growth in the value of the land.

+100

Million invested

70+

Partner farmers

impacted

5

GLOBAL INVESTORS IN 5 CONTINENTS

2015

Established